Category II AIFs in India 2025: Where Smart Money Is Moving

Introduction: Why Investors Can’t Afford to Miss This Wave

Category II AIFs in India 2025 are where the country’s wealthiest families, HNIs, and institutions are moving their capital. With over ₹3.6 lakh crore already raised by AIFs, Category II is leading the charge — focusing on growth equity, secondaries, and pre-IPO opportunities.

The message is clear: allocations are filling fast. Miss these funds now, and you’ll be watching others capture 20–30% IRRs while you settle for single-digit returns.

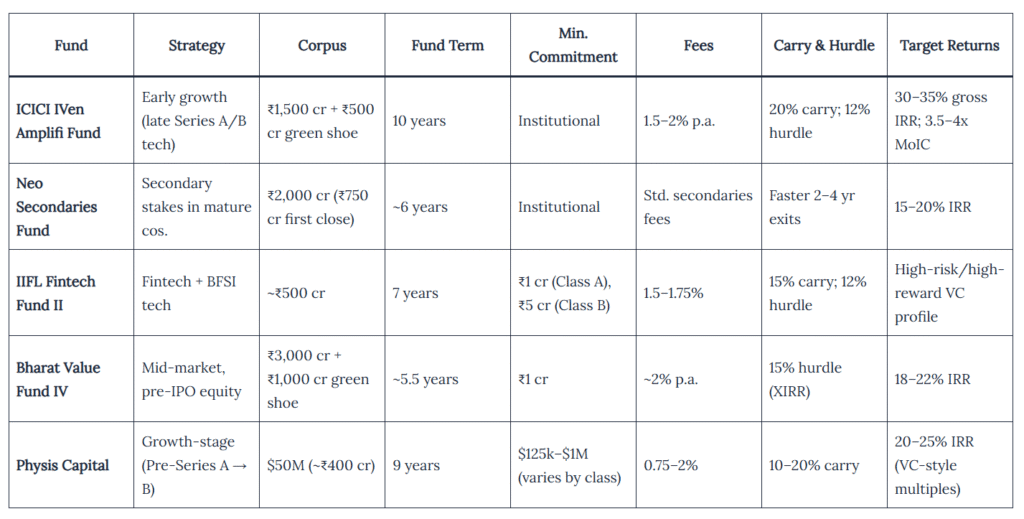

Quick Snapshot: Category II AIF Fund Terms in 2025

Deep Dive: The Hottest Category II AIFs in India

ICICI Venture – IVen Amplifi Fund

- Size: ₹1,500 crore (+₹500 crore green shoe)

- Fund Term: 10 years; 5-year investment period

- Fees: 1.5–2% p.a. | Hurdle: 12% IRR | Carry: 20% (full catch-up)

- Returns: Targeting 30–35% gross IRR; 3.5–4x MoIC

- FOMO angle: Backed by ICICI’s brand and network, this fund is oversubscribed fast. If you want exposure to late-stage Indian tech leaders before IPO, you can’t wait.

Neo Secondaries Fund

- Size: ₹2,000 crore (₹750 crore first close already done)

- Fund Term: ~6 years

- Focus: Acquiring secondary stakes in profitable, mature private companies

- Returns: 15–20% IRR, with quicker liquidity (2–4 year exits)

- FOMO angle: Access to late-stage unicorns before IPOs at attractive valuations. These deals rarely come back once the fund closes.

IIFL Fintech Fund II

- Size: ~₹500 crore

- Fund Term: 7 years

- Commitment: ₹1 crore (Class A) | ₹5 crore (Class B)

- Fees: 1.5–1.75% | Carry: 15% | Hurdle: 12% IRR

- Track record (Fund I): 80% IRR on first exit, 26× revenue growth, 0 write-offs

- FOMO angle: India’s fintech industry is projected to hit $1.5 trillion. Miss this, and you could miss the next Paytm, Zerodha, or Razorpay.

Bharat Value Fund IV

- Size: ₹3,000 crore (+₹1,000 crore green shoe)

- Fund Term: ~5.5 years (shorter than most PE funds)

- Focus: Pre-IPO mid-market companies (₹300–1,000 crore revenues)

- Returns: 18–22% IRR | Hurdle ~15%

- FOMO angle: Quicker IPO/M&A exits (30–36 months) mean faster liquidity. This is the sweet spot for investors who don’t want to wait a full decade.

Physis Capital – India Growth Opportunity Fund

- Size: $50M (~₹400 crore) | ~₹150–200 crore already raised

- Fund Term: 9 years (till 2032)

- Fees & Carry: 0.75–2% fees | 10–20% carry depending on class

- Portfolio Plan: 15–20 concentrated startup bets

- Returns: Aims for 20–25% IRR via high-growth startups

- FOMO angle: India is expected to mint 100+ unicorns. Physis aims to catch them early. Delay, and the unicorns are gone.

Expected Returns: The 20–30% IRR Club

Traditional FDs (6–7%) and even equity mutual funds (12–15%) pale in comparison to the 20–30% gross IRRs these AIFs are targeting.

But here’s the truth:

- Gross vs Net: After 1.5–2% management fees and 20% carry, net returns will be lower — often in the high-teens to low-20s IRR range.

- Dispersion: Top funds deliver 25%+, while others may underperform.

Still, this is the asset class where India’s wealthy are doubling allocations — and they’re not waiting around.

Why Category II AIFs Are Winning Investor Capital

- Pre-IPO & Secondaries: Shorter liquidity cycles (2–4 years for some deals).

- Aligned incentives: GP commitment + performance-based carry.

- Diversification: From fintech and tech to mid-market industrials.

- Credibility: SEBI-regulated, institutional governance.

Conclusion: Don’t Be Left Out

Category II AIFs in India 2025 are no longer niche — they’re the go-to allocation for smart money.

- ICICI IVen = late-stage tech scale-ups

- Neo = secondaries & quicker exits

- IIFL = fintech unicorn hunters

- Bharat Value Fund = pre-IPO gems

- Physis = growth-stage VC bets

Each of these funds is closing fast. Delay, and you’ll be locked out or paying higher valuations later.

The question is: Will you ride India’s next wealth wave through Category II AIFs, or watch from the sidelines?

FAQs on Category II AIFs in India (2025)

1. What is a Category II AIF in India?

A SEBI-regulated Alternative Investment Fund that invests in private equity, growth capital, secondaries, and pre-IPO opportunities without heavy leverage.

2. What returns can investors expect in 2025?

Most funds target 18–30% IRR gross. Net returns after fees typically land in the high-teens to low-20s IRR range.

3. What is the minimum investment?

SEBI mandates ₹1 crore as the minimum ticket size. Some funds have higher thresholds depending on the share class.

4. Why are HNIs & family offices moving into AIFs?

For higher returns, diversification, pre-IPO access, and faster exits compared to listed equities or real estate.

5. Which sectors are hot in 2025?

Fintech, generative AI, consumer tech, SaaS, healthcare, deep-tech, and mid-market industrials.