Why the Indian Rupee Is Weakening: Data, Drivers & What It Really Means

Executive Summary (Must-Read)

- The Indian rupee sliding toward ₹91/USD in 2025 looks alarming but is not a currency crisis.

- The rupee is down ~6% in 2025, which is higher than its long-term average, but far lower than stress years like 2008 (24%), 2013 (23%), or 2022 (11%).

- The primary drivers are foreign portfolio outflows, strong dollar dynamics, RBI’s managed depreciation strategy, and forward-market pressures, not macro instability.

- India’s fundamentals remain supportive: resilient exports, high real yields, strong corporate earnings, and adequate FX reserves.

- This is best understood as a managed adjustment, not a meltdown — and historically, such phases often reverse faster than expected.

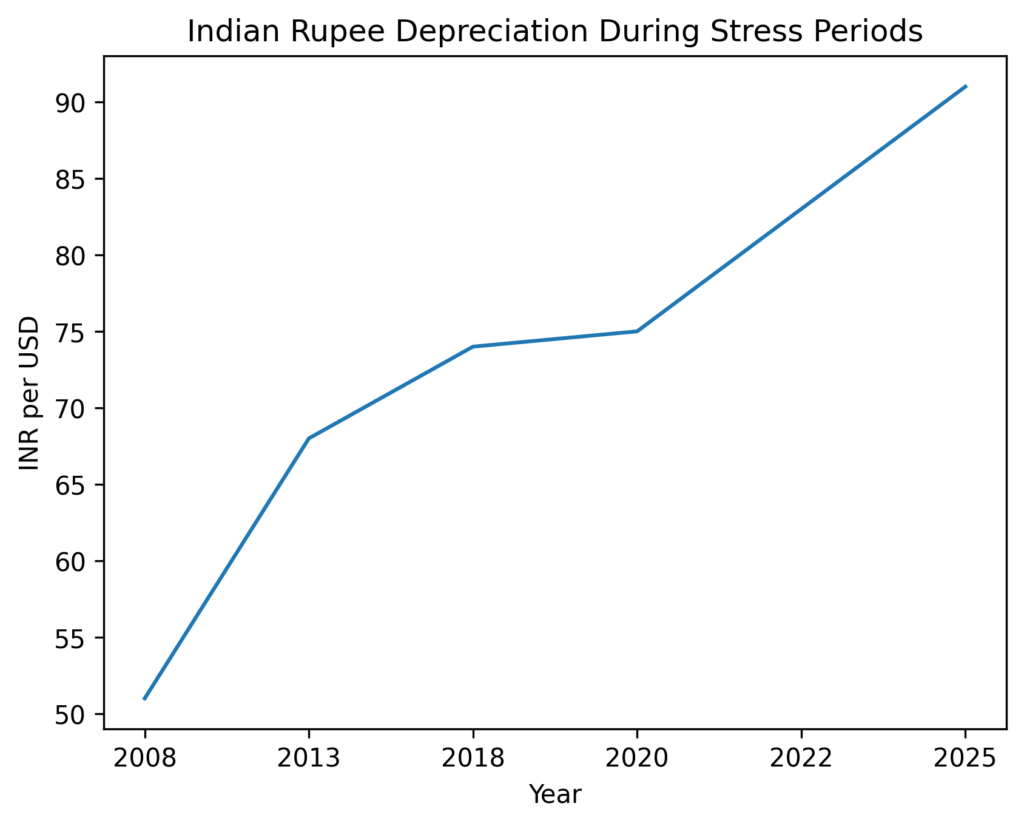

1. Putting the Rupee Fall in Perspective

Headline levels like ₹90 or ₹91 matter psychologically, but percentage change matters more than absolute numbers.

Table 1: Rupee Depreciation During Major Stress Periods

| Year | INR/USD (Start) | INR/USD (End / Peak) | Annual Depreciation |

|---|---|---|---|

| 2008 | 39 | 51 | 24% |

| 2013 | 55 | 68 | 23% |

| 2018 | 63 | 74 | 17% |

| 2020 | 71 | 75 | 6% |

| 2022 | 74 | 83 | 11% |

| 2025 | 83 | 91 | ~6% |

Key Insight:

2025 looks uncomfortable mainly because of the absolute level, not because the speed of depreciation is extreme.

2. What the Chart Tells Us: Long-Term Rupee Reality

Chart 1: INR/USD During Stress Periods (2008–2025)

(See chart above)

Interpretation:

- The rupee weakens in global stress cycles, not in isolation.

- Each large fall historically occurred alongside global shocks:

- 2008: Global Financial Crisis

- 2013: Taper Tantrum

- 2022: Fed tightening + Ukraine war

- 2025: Capital rotation + global trade stress

Yet none turned into a balance-of-payments crisis.

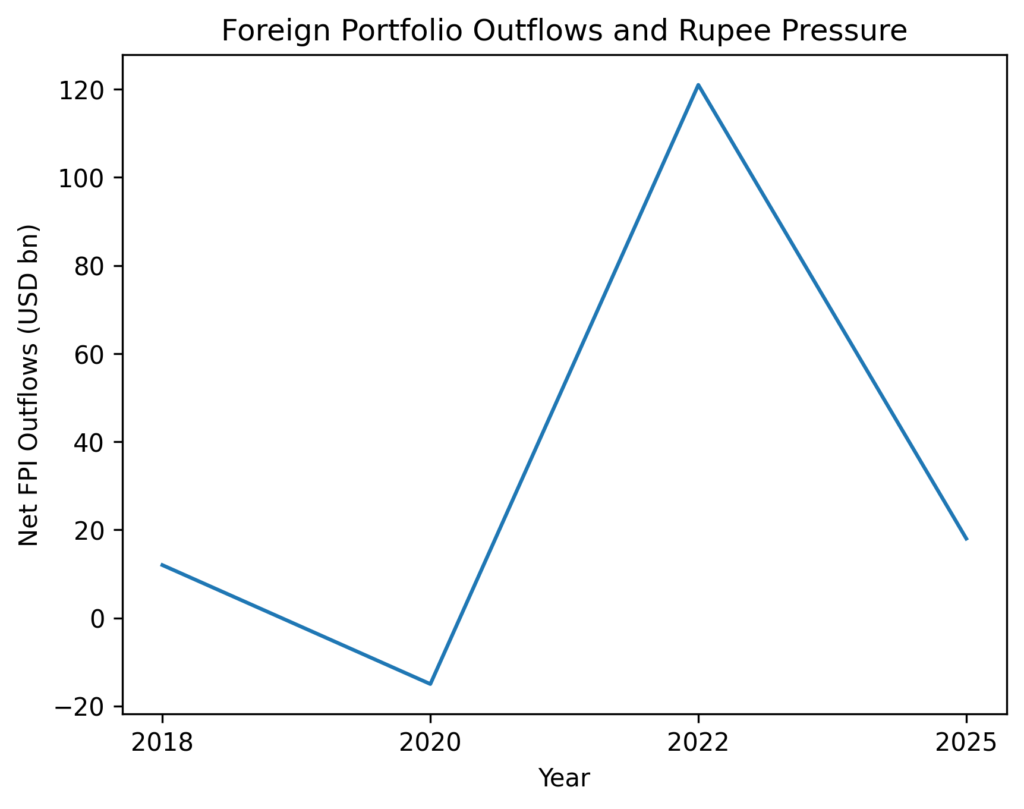

3. The Primary Driver in 2025: Capital Flows

Foreign Portfolio Investors (FPIs)

The most direct pressure on the rupee today is money moving out.

Table 2: FPI Outflows vs Rupee Weakness

| Year | Net FPI Outflows (USD bn) | INR Depreciation |

|---|---|---|

| 2018 | 12 | 9% |

| 2020 | -15 (inflows) | 6% |

| 2022 | 121 | 11% |

| 2025 | ~18 | ~6% |

Chart 2: FPI Outflows and Rupee Pressure

(See chart above)

Key Insight:

Whenever FPIs pull capital from both equity and debt, the rupee weakens — regardless of domestic growth strength.

4. Why RBI Is Allowing the Rupee to Slide (Quietly)

India follows a managed-float regime, not a fixed exchange rate.

RBI’s Current Strategy:

- Avoid sharp volatility, not defend a specific level

- Preserve FX reserves for disorderly moves

- Allow gradual depreciation to:

- Support exports

- Absorb global shocks

- Avoid sudden liquidity tightening

This explains:

- Light intervention in spot markets

- Greater use of forwards, swaps, and liquidity tools

- No panic even after ₹90 was breached

5. The Role of Offshore & Forward Markets

Once ₹90 was breached:

- Offshore traders increased short positions

- Forward premiums rose

- NDF markets began pricing further weakness

This creates momentum pressure, but not necessarily fundamental weakness.

Important:

Such positioning reverses quickly when:

- Dollar weakens

- RBI signals discomfort

- Capital flows stabilize

6. The Other Side of the Story: Why This Isn’t Bearish Long-Term

Despite rupee weakness, several pro-rupee forces remain intact:

Structural Positives

- High Indian real yields vs developed markets

- Resilient exports, especially services

- Strong corporate earnings

- Large FX reserves buffer

- Stable domestic growth

Historically, these factors cap extreme depreciation.

7. Who Wins and Who Loses from a Weaker Rupee?

Beneficiaries

- Exporters (IT, pharma, manufacturing)

- Remittance recipients

- Companies with USD revenues

Losers

- Importers (oil, electronics)

- Overseas travel & education

- Companies with unhedged foreign debt

For investors, the impact is sector-specific, not economy-wide.

8. Final Takeaway: How to Read the Rupee Correctly

The rupee near ₹91 is:

- Uncomfortable but not dangerous

- Market-driven, not panic-driven

- Managed, not abandoned

Bottom Line

This episode is best described as a controlled currency adjustment during a global capital rotation, not a loss of macro credibility.

It would not take much — improving risk sentiment, easing dollar strength, or returning flows — to change the rupee narrative meaningfully.

Currency movements, interest rates, and capital flows shape market outcomes. Kalviro Ventures helps investors interpret these signals and position portfolios for long-term growth across cycles.