Portfolio Management Services (PMS) in India

At Kalviro Ventures, we provide Portfolio Management Services (PMS) designed for India’s High Net Worth Individuals (HNIs) and sophisticated investors. With a minimum investment threshold of ₹50 Lakhs, PMS offers customized, actively managed portfolios that aim to deliver superior long-term returns compared to traditional mutual funds.

What is PMS?

PMS is a professional investment service where expert fund managers design and manage your equity or multi-asset portfolio. Unlike mutual funds, PMS portfolios are tailored to your goals, risk appetite, and investment horizon, giving you greater control and transparency.

We continuously monitor market trends and PMS performance, ensuring our recommendations remain aligned with your evolving financial needs, helping you achieve sustainable growth and long-term investment success.

Our Role in PMS Distribution

We partner with a select group of reputed PMS providers known for their proven track records and specialized investment strategies. Our priority is to ensure that you have:

- Wide access to top-tier PMS products

- Expert guidance in selecting the right PMS provider

- Ongoing support to monitor and review your portfolio’s progress

By collaborating with trusted AMCs, we provide you with a curated selection of PMS options tailored to your investment style.

We work closely with you to understand your unique financial profile and recommend PMS strategies that best match your goals and comfort level with risk.

We offer you access to a carefully selected list of PMS products managed by expert portfolio managers from leading AMCs.

What You Gain with Kalviro Ventures

Personalized Guidance

We work closely with you to understand your unique financial profile and recommend PMS strategies that best match your goals and comfort level with risk.

Curated PMS Selection

We offer you access to a carefully selected list of PMS products managed by expert portfolio managers from leading AMCs.

Ongoing Support

Our relationship does not end after you invest. We regularly review and discuss the performance of your PMS investments to ensure they continue to align with your long-term financial objectives.

Why Choose PMS With Kalviro Ventures?

Personalized Strategies: Tailor-made portfolio allocation based on your financial objectives and risk profile.

Curated PMS Selection: Access leading PMS providers in India with proven track records.

Expert Fund Managers: Benefit from active research, stock selection, and disciplined risk management.

Transparent Reporting: Regular portfolio updates, performance tracking, and clear fee structures.

Long-Term Wealth Creation: Designed for investors who seek alpha beyond mutual funds.

The PMS Selection Process with Kalviro

Step 1

Understanding You

We begin by carefully assessing your:

- Investment goals

- Risk appetite

- Expected time horizon

- Liquidity preferences

Step 2

Recommending PMS Options

Based on our assessment, we recommend suitable PMS offerings from our partner AMCs that align with your profile.

We carefully evaluate PMS options to match clients’ objectives, risk tolerance, and preferences.

Step 3

Onboarding and Investment

We assist you through the onboarding process and ensure smooth documentation, regulatory compliance, and investment setup.

Step 4

Ongoing Monitoring

We regularly track the performance of your PMS investments, facilitate portfolio reviews, and help you make timely adjustments if required.

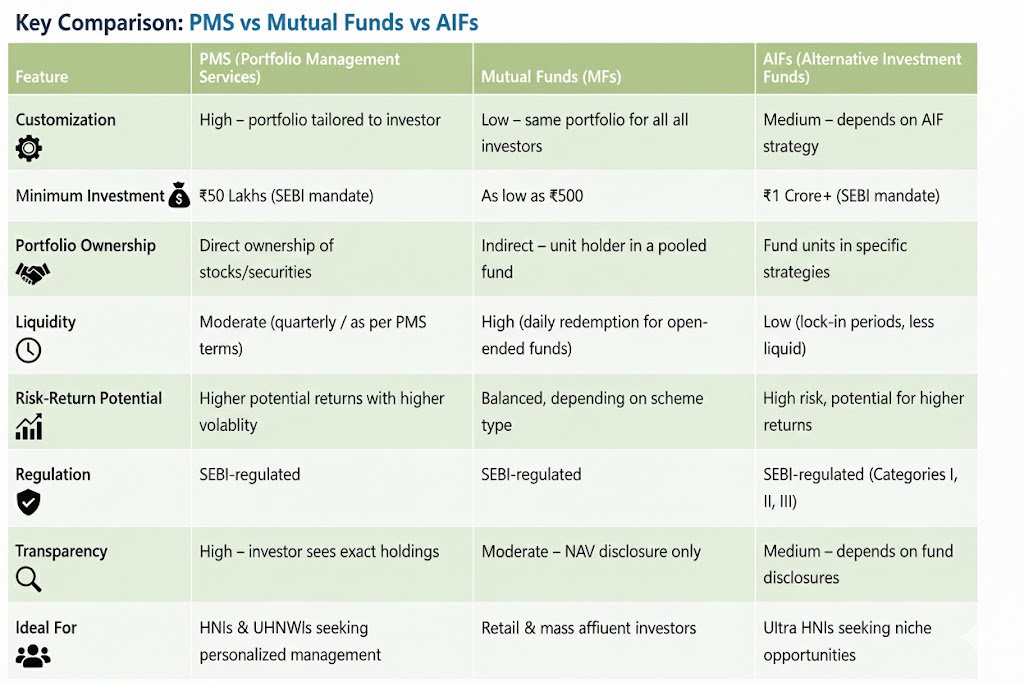

PMS vs Mutual Funds vs AIFs

Customization: PMS offers high personalization, while mutual funds are standardized, and AIFs fall in between.

Minimum Investment: PMS requires ₹50 Lakhs, mutual funds as low as ₹500, and AIFs ₹1 Crore+.

Liquidity: PMS allows moderate liquidity, mutual funds offer daily redemption, while AIFs have lock-ins.

Risk-Return Potential: PMS has high upside with higher volatility, mutual funds are balanced, and AIFs involve higher risk with potentially higher returns.

Who Should Invest in PMS?

PMS is ideal for:

HNIs & UHNWIs seeking personalized wealth management solutions

Investors willing to commit ₹50 Lakhs or more

Individuals aiming for superior long-term returns vs mutual funds

Families, trusts, or institutions looking for diversified investment strategies

- If your investment horizon and risk appetite are higher, you may also consider exploring *Alternative Investment Funds (AIFs).”

Our PMS Process

Risk Profiling: Understand your financial goals, risk appetite, and liquidity needs.

Strategy Selection: Shortlist PMS offerings across equity, hybrid, or thematic portfolios.

Onboarding: Assistance with SEBI documentation, KYC, and compliance.

Portfolio Management: Active stock selection, allocation, and monitoring by professional fund managers.

Performance Reviews: Regular updates, rebalancing, and transparent performance reports.

Risks & Considerations

While PMS can deliver strong long-term returns, investors should consider:

Market volatility and sector concentration risks

Higher minimum investment requirement (₹50 Lakhs)

Performance varies by fund manager expertise

Exit load or liquidity constraints on certain PMS products