Late-Stage Startup Funding in India: PE-VC Capital Flow in H1 2025

Introduction

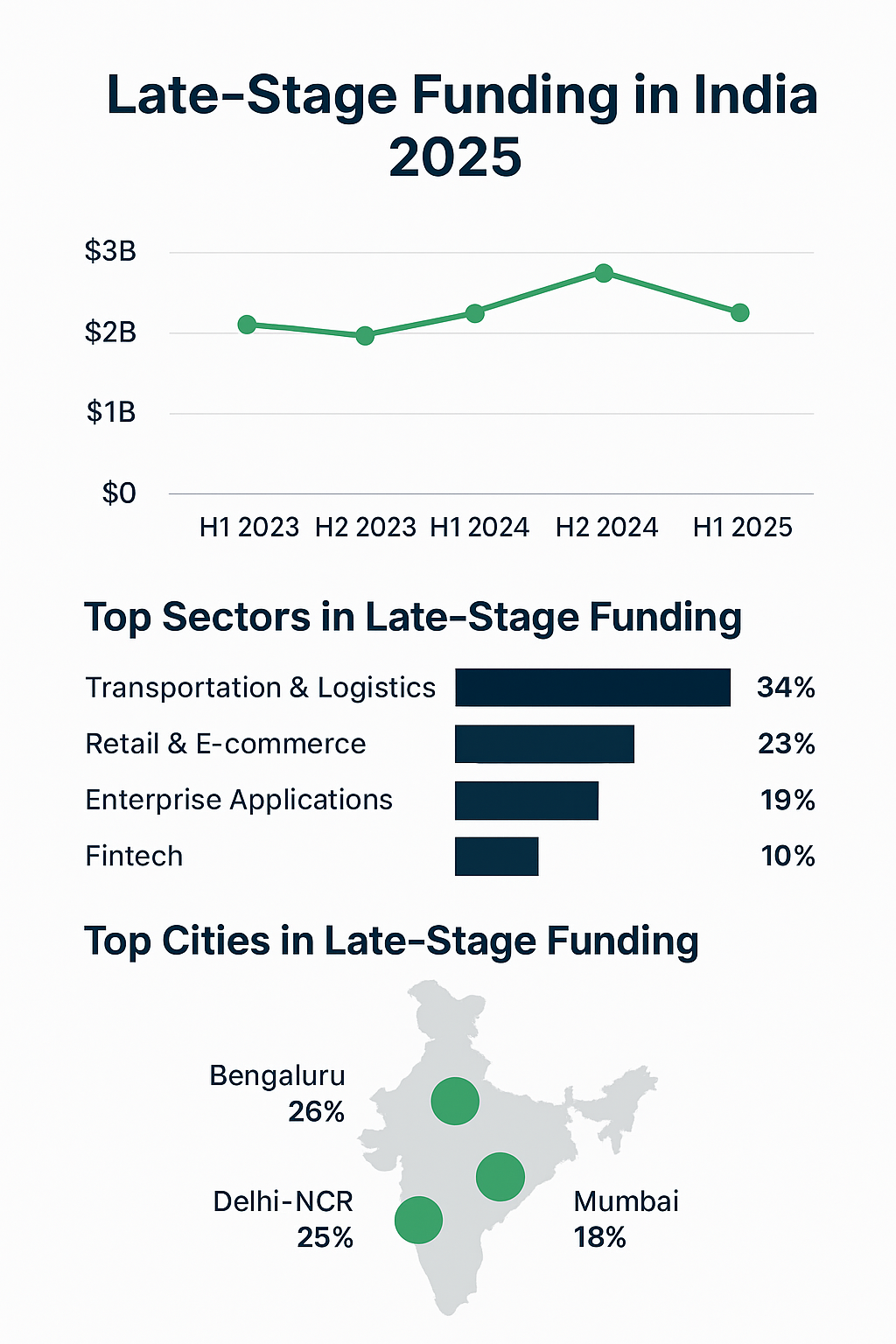

Late-stage funding in India 2025 slowed in H1, with startups raising $2.7B, reflecting investor caution but continued bets on EVs, AI, and logistics. The first half of 2025 presented a mixed picture for India’s startup ecosystem. While early- and mid-stage startups continued to attract consistent investor interest, late-stage funding flows slowed considerably compared to previous years. This slowdown reflected a broader global recalibration of venture capital (VC) and private equity (PE) investments, influenced by macroeconomic uncertainties, interest rate movements, and cautious investor sentiment.

Despite this, late-stage Indian startups—those raising Series C and beyond, pre-IPO rounds, or attracting significant PE participation—still managed to secure substantial funding. In H1 2025, late-stage startups raised approximately $2.7 billion, marking a 27% year-on-year decline and a 25% drop from H2 2024. Yet, this pool of capital, though reduced, highlighted how selective investors are becoming while backing companies with strong fundamentals, clear revenue streams, and paths to profitability.

This article explores where PE-VC capital flowed in late-stage startups during H1 2025, breaking down trends by sector, city, notable startups, key investors, and providing insights into the outlook for the second half of the year.

Macro Trends in Late-Stage Funding India 2025

The late-stage funding slowdown was part of a broader correction across global venture capital markets. Investors, especially international funds, pulled back from writing large checks as they weighed portfolio risks and macroeconomic headwinds.

- Funding decline: Late-stage Indian startups secured $2.7B in H1 2025, compared to over $3.7B in H1 2024, reflecting a 27% YoY drop. Sequentially, it was 25% lower than the $3.6B raised in H2 2024.

- Overall PE-VC activity: Across all stages, PE-VC investments in India totaled $14.8B in H1 2025. Of this, around $5.1B went into true late-stage deals, defined as Series G rounds or funding for companies over 10 years old.

- Shift in focus: Investors are now backing fewer startups but deploying larger amounts selectively in resilient sectors such as EVs, logistics, AI, and healthtech.

Compared to the boom of 2021–2022, when late-stage rounds routinely exceeded $1 billion, the current environment is more cautious. However, the IPO pipeline in India, with companies like Zepto and Ola Electric preparing listings, suggests that late-stage capital could bounce back in the second half of 2025.

Sectors Driving Late-Stage Startup Funding in H1 2025

City Concentration

India’s startup capital remained highly concentrated in a few cities:

- Bengaluru: Secured 26% of late-stage funding. The city continues to be the hub for AI, SaaS, and logistics-tech startups.

- Delhi-NCR: Accounted for 25% of late-stage deals, driven by fintech, mobility, and consumer-tech.

- Mumbai: Emerging strongly in fintech and EV-related startups.

- Other cities: Hyderabad and Chennai also saw selective late-stage activity, particularly in healthtech and enterprise software.

Sectoral Momentum

Certain sectors stood out in H1 2025, reflecting both investor priorities and consumer demand:

- Transportation & Logistics Tech – capital magnet with Porter and Spinny leading.

- Retail & E-commerce – Zepto, Jumbotail, and Flipspaces attracted strong rounds.

- Enterprise Applications (SaaS, HRTech) – Darwinbox and Innovaccer raised large late-stage deals.

- Fintech – Though fintech saw a broader slowdown, startups like Zolve and Leap Finance secured significant rounds.

- EVs and Mobility – Erisha E Mobility’s billion-dollar raise was the single largest deal.

- Aerospace & Defense – Raphe mPhibr made headlines with a $100M round, signaling new investor interest in deep tech.

Top Late-Stage Deals in India 2025: Who Raised Big?

The top deals of H1 2025 provide insight into where investors placed their biggest late-stage bets.

| Startup | Sector | Funding (H1 2025) | Stage | City |

|---|---|---|---|---|

| Erisha E Mobility | EV & Mobility | $1.0B | Series D | Delhi-NCR |

| Impetus Technologies | Artificial Intelligence | $350M | Growth/PE | Bengaluru |

| Innovaccer | Healthtech SaaS | $275M | Late Growth | Noida |

| GreenLine | Clean Logistics | $275M | Series A* | Mumbai |

| Infra.Market | Infra-Tech | $222M | Series F | Mumbai |

| Zolve | Fintech | $251M | Late Growth | Bengaluru |

| Porter | Logistics | $300M+ (extended) | Series E | Bengaluru |

| Spinny | Used Cars/E-commerce | $100M+ | Series F | Gurgaon |

| Darwinbox | HRTech | $100M+ | Series E | Hyderabad |

| Jumbotail | B2B E-commerce | $100M+ | Series D | Bengaluru |

| Leap Finance | Ed-Fintech | $100M+ | Late Growth | Bengaluru |

| Raphe mPhibr | Aerospace & Defense | $100M | Series B | Noida |

*While GreenLine’s $275M raise was technically a Series A, its size and investor profile made it comparable to a late-stage round.

These deals highlight that investors prioritized scale-ready companies with clear revenue visibility, particularly in logistics, healthtech, and clean energy.

Other Noteworthy Fundraises

Not all late-stage deals were mega-rounds. Several startups raised smaller but strategically significant rounds:

- Zepto: Raised $450–500M at a $7B valuation; IPO preparations are underway.

- Flipspaces: Secured $50M (Series C) for international expansion in interior tech.

- FirstClub: Raised $23M, valuing it at $120M, showing that quick commerce still excites investors despite challenges.

Investor Landscape

Top Late-Stage Backers

- SoftBank Vision Fund: Continued focus on growth-stage bets, including fintech and mobility.

- Premji Invest: Increased exposure to EV and SaaS.

- Sofina: Played a strong role in fintech and SaaS rounds.

Active Investors Across Stages

- Accel, LetsVenture, AngelList – While these are more active in early-stage, they also doubled down on late-stage follow-ons.

Fintech-Specific Late-Stage Backers

- Lathe Investment, Sofina, SoftBank VF were among the most prominent in backing fintech startups like Zolve and Leap Finance.

The investor mix suggests that global funds remain cautious but engaged, while Indian family offices and corporates are stepping up to fill funding gaps.

Outlook for H2 2025

While H1 was marked by a decline in late-stage capital flow, there are several reasons to be cautiously optimistic about H2 2025:

- IPO Momentum – Zepto, Ola Electric, and FirstCry are preparing public listings, which could boost late-stage investor confidence.

- Sectoral Opportunities – EVs, logistics, and AI continue to attract global attention.

- Investor Strategy Shift – PE funds are increasingly focusing on profitability and consolidation plays.

- Global Macro – Any easing in interest rates could re-ignite cross-border late-stage inflows into India.

Thus, while funding volumes may not return to 2021 levels, selective mega-deals are likely to continue, supporting India’s maturing startup ecosystem.

Conclusion

Late-stage startup funding in India during H1 2025 was defined by selectivity, resilience, and strategic bets. With $2.7B raised, the ecosystem saw fewer but larger deals concentrated in EVs, logistics, AI, fintech, and healthtech.

Mega-rounds such as Erisha E Mobility ($1B) and Porter ($300M+) demonstrated that capital remains available for category leaders, even as many startups struggled to raise. The investor mix—balancing global giants like SoftBank with domestic funds like Premji Invest—highlighted the evolving funding landscape.

Looking ahead, IPO activity and sector-specific growth will determine whether H2 2025 sees a rebound in late-stage funding. India’s late-stage ecosystem, though navigating turbulence, is increasingly maturing, with investors rewarding profitable growth and market leadership over hype-driven valuations.

For tailored investment strategies that go beyond market noise, connect with wealth management experts.