Alternative Investment Funds (AIF) in India

Unlock Exclusive Investment Opportunities with AIFs

At Kalviro Ventures, we connect High Net Worth Individuals (HNIs), Ultra-HNIs, family offices, and institutional investors to carefully selected Alternative Investment Funds (AIFs) through our trusted distribution partnerships with leading Asset Management Companies (AMCs).

We do not manufacture or manage our own AIFs—instead, we provide you with transparent access to high-quality AIF solutions managed by some of India’s most experienced fund managers. Our focus is to help you diversify your portfolio beyond traditional equities, mutual funds, and fixed-income instruments.

What Are Alternative Investment Funds (AIFs)?

AIFs are privately pooled investment vehicles regulated by SEBI that invest in assets and strategies not typically available in public markets.

AIFs provide exposure to:

Private equity

Venture capital

Structured debt

Long-short equity

Special situations

Unlisted securities

AIFs are ideal for sophisticated investors seeking:

Portfolio diversification

Access to niche, high-growth opportunities

Strategies with higher risk-return potential

- 1. Portfolio diversification

- 2. Access to niche, high-growth opportunities

- 3. Strategies with higher risk-return potential

Categories of AIFs in India

Category I AIFs

- Early-stage startups, SMEs, infrastructure, and social ventures.

- Suitable for investors looking to support long-term development sectors.

Category II AIFs

Private equity funds, structured debt, and unlisted opportunities.

Popular among HNIs seeking exposure to growth-stage businesses.

Category III AIFs

Employ long-short equity, arbitrage, derivatives, and event-driven strategies.

Designed for experienced investors seeking alpha-generation through sophisticated strategies.

Why Consider AIFs for Your Portfolio?

Alternative Investment Funds are designed for investors who want to:

Diversify beyond traditional stocks and bonds.

Access private market opportunities not available in mutual funds.

Target higher long-term returns with professional management.

Invest in niche strategies aligned with global wealth-building practices.

Our Role in AIF Distribution

At Kalviro Ventures, we are your trusted partner for AIFs:

Wide access to AIFs across categories through reputed AMCs.

Unbiased recommendations tailored to your goals—not tied to a single product.

Support at every stage—from onboarding to performance monitoring.

Transparent insights on AIF structures, risks, and strategies.

The AIF Selection Process with Kalviro Ventures

Step 1: Needs Assessment

We analyze your investment goals, risk profile, liquidity preferences, and long-term vision.

Step 2: Shortlisting AIFs

Based on your profile, we recommend suitable AIFs from multiple fund houses.

Step 3: Onboarding & Documentation

We ensure smooth application, compliance, and regulatory checks.

Step 4: Ongoing Monitoring

We provide continuous updates, performance reviews, and fund communications.

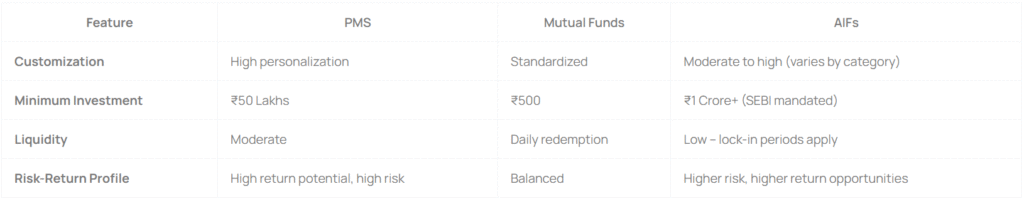

PMS vs Mutual Funds vs AIFs (Comparison Table)

Who Should Invest in AIFs?

AIFs are most suitable for:

HNIs and Ultra-HNIs with ₹1 Crore+ to invest.

Investors seeking long-term wealth creation.

Families, trusts, or institutions exploring niche strategies.

Individuals comfortable with illiquidity and higher risk exposure.

Also explore our PMS Solutions for a comparative approach.

Why Kalviro Ventures for AIFs?

01.

Wide Access:

Curated AIFs across multiple categories.

02.

Neutral Advisory:

Client-first approach with unbiased recommendations.

03.

Expert Partnerships:

Access to India’s leading fund managers.

04.

Simplified Process:

From onboarding to monitoring, we handle everything.

05.

Transparent Support:

Ongoing reporting, reviews, and clarity on risks.

Frequently Asked Questions (FAQs)

Q1. What is the minimum investment in AIFs?

Q2. How are AIFs different from PMS and Mutual Funds?

Q3. Are AIF returns guaranteed?

Q4. Can NRIs invest in AIFs?

Q5. How are AIFs taxed?

Q1. What is the minimum investment in AIFs?

As per SEBI regulations, the minimum investment in AIFs is ₹1 Crore.

Q2. How are AIFs different from PMS and Mutual Funds?

AIFs offer access to private markets and niche strategies. PMS focuses on personalized equity portfolios, while mutual funds are standardized and widely accessible.

Q3. Are AIF returns guaranteed?

No. AIF returns depend on market conditions, fund strategy, and manager performance.

Q4. Can NRIs invest in AIFs?

Yes, NRIs can invest in AIFs in India, subject to SEBI and RBI regulations.

Q5. How are AIFs taxed?

AIF taxation depends on the category. Category I & II are taxed at the investor level, while Category III may be taxed at the fund level.